Are you contemplating entering the world of investments but find yourself short on available money? Do you have the desire to invest but lack guidance on where to begin? Click to delve deeper.

Every individual who has ventured into the realms of shareholding, properties, or other forms of investments has grappled with questions surrounding how and where to invest, as well as sourcing the necessary capital.

Upon perusing this article, you will gain insights into methods of generating the funds needed to embark on your investment journey.

As a human being, you are inherently an investor.

If you are pursuing education, you have already taken the first steps towards investing in your future career or business. Similarly, if you are employed, you recognize the value of the investments you’ve made in your past—be it in education, skills, or experience—which contribute to your enhanced earning potential. Thus, it would be erroneous to assume that you are a newcomer to this realm.

Indeed, for those new to the concept of investing as a means to financial growth, this article will serve as a valuable introduction to the world of investments.

Initially, where can you acquire the required funds?

Take a moment to reflect on the expenses you incur in your daily life and contemplate who is funding them. If you are working to meet your financial needs, it merely requires a bit of discipline and a willingness to make modest sacrifices to transform yourself into a financial investor.

Exactly, you have options. If you’re paid by the hour, working some overtime can be a solid strategy. On the other hand, if you receive a fixed monthly salary, consider either cutting back on expenses or discussing with your manager the possibility of taking on extra responsibilities in exchange for additional compensation. Hence, you can either trim a fixed small expense or dedicate a few extra hours solely for investing.

After addressing the financial aspect, the subsequent pivotal inquiry for an investor is determining where to allocate their funds. My primary recommendation is to start by observing your immediate surroundings, specifically within your home. It could be any area – the kitchen, bathroom, bedroom, or even your wardrobe. Seek out established brands with a robust track record.

For example, Tata has been a renowned provider of salt for generations. East End is a reliable source for various global groceries. Whether it’s Loreal for your shampoo or Gucci for handbags and watches, opt for brands with a trusted history.

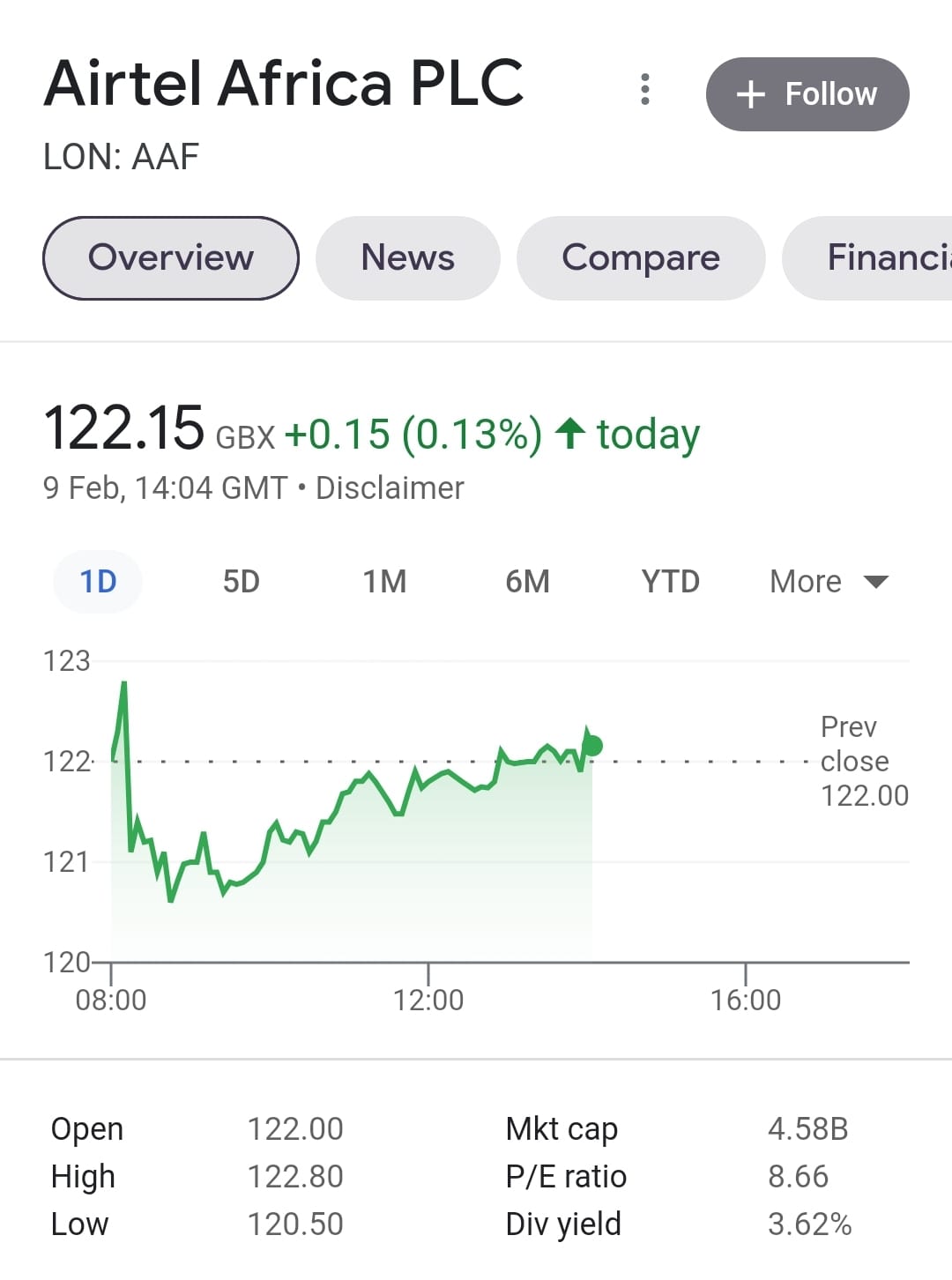

Becoming an investor doesn’t necessitate possessing large sums of money in the hundreds or thousands. You can commence with as little as one pound. That’s correct, you read it correctly. Shares are available at various price points, allowing you to initiate your investment journey with a modest amount.

Points to remember while you invest

-Absolutely, it’s a prudent strategy to diversify your investments. Avoid putting all your money into a single share or sector. For instance, if you’ve already invested in one alcohol brand, it’s advisable not to duplicate your investment with another brand in the same sector. This is because sectors often move in tandem. To mitigate the risk of a significant downturn in your investment, it’s wise to spread your investments across different areas.

-The share market tends to grow on average over time. However, if you check prices daily, it can lead to unnecessary stress and impatience, especially if you see your shares not increasing. Remember, investing is a long-term endeavour. An impatient investor may end up making hasty decisions that lead to losses. Therefore, it’s crucial to always maintain patience and a long-term perspective in the market.

-Setting goals for both inputs (the amount you invest) and outputs (the returns you expect) is crucial. Without clear goals, there’s a tendency to become complacent about further investments. For instance, if you aim to invest £10 daily, you’re looking at an assumed investment of £220 monthly or £2640 annually.

Continue reading for your own benefit, please

However, targeting £3000 might be a wiser choice for added motivation. It’s important, though, to avoid setting unrealistic targets. Aim for steady, incremental growth rather than rapid ascension. With a ladder, a setback is only one or two steps, but with a lift, it can lead to a much bigger setback.

– Absolutely, taking advantage of a dip in the market can be a strategic move. Often, news events can trigger a sell-off, impacting not just specific shares but entire sectors. Additionally, there are times when a share’s price may drop without any apparent direct cause. This presents an opportunity to potentially lower your average cost by purchasing more shares at a discounted price. It’s a savvy way to capitalize on market fluctuations and potentially increase your overall returns in the long run.

-You’ve hit the nail on the head. Occasionally, a share’s value skyrockets, promising substantial profits upon sale. However, upon selling, you may realize that you’ve actually incurred losses due to selling too early. This underscores the importance of allowing such market influencers to continue their upward trajectory on your behalf, rather than prematurely divesting from them. Patience can often lead to more substantial gains in the long run.

Still continue

-Continuously delving into history provides a genuine glimpse into the past. I firmly believe that the past serves as a mirror to the future, given that history has a tendency to repeat itself. The shares you intend to hold for the long term should be regarded much like family members. It’s imperative to stay informed about their ins and outs regularly. A quick Google search using the brand name and terms like upcoming projects, significant accomplishments of the year, or recent challenges will yield relevant information to keep you updated. Most notably, consistent searches indicate your keen interest in any fresh developments about them.

-Avoid putting your money into options and futures as they are more suited for short-term trading rather than long-term investment. We have plans to compose a comprehensive blog on options and futures in the coming future.

In the end