Share market investment account – A beginner’s guide.

Investment is an important aspect of life. Everybody in this fast paced world wants to lead a good stable life with a perfect planning to secure future of the family along with retirement. The best standard way available is through state pensions where govt takes a part of our money and locks it for our retirement.

But there are circumstances in life when you have spare money that you can keep safe for a rainy day. Now Imagine the money kept is in a locker for lets say 10 years, do you think it will carry the same value in monetary terms after 10 years. Well, the answer is no. Because inflation will reduce its value. In other words, think what were you paying for diesel 10 years ago and how much it increased in 10 years.

There are alternatives to keeping that money in the locker i.e. Savings account, Private pension , bonds, cryptocurrencies, shares and stocks etc. Savings Accounts gives us immediate access of all the money in the account with no market risks along with some basic rate of interest paid. But that hardly fights the actual inflation in the long run. Instead, investments in the share market tends to bring better returns in the long run. But at the same time investment in share market is highly subject to market risks. To invest directly in shares one needs to get an investment account.

What is an Investment Account

An account that allows us to get market exposure to get better returns on the same money. There are two incomes related to investment account.

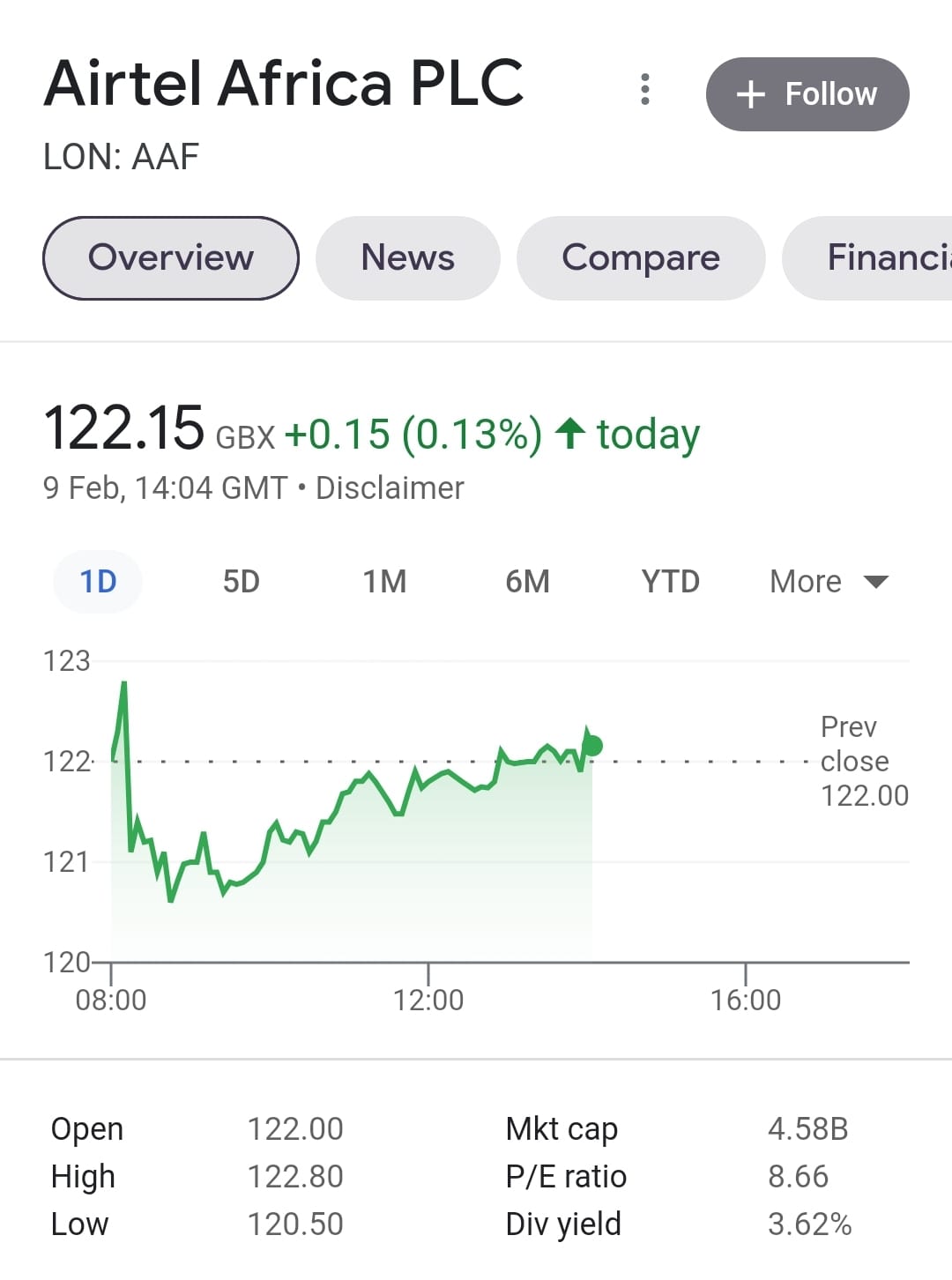

1) Dividend:

Profit of the company distributed to its shareholders

2) Increase in share price.

With time price of shares of profit generating companies increase that further increases the value of the portfolio of the investor.

Types of Investment accounts in UK

1) ISA

ISA stands for Individual savings account for shares and stocks. With this account a person is able to directly invest in the market with an investment limit of 20,000 pounds per financial year. This account gets a waive from all taxes( Income Tax and Capital Gains Tax). It is an individual account and is managed solely by the account holder. If a person wants to invest beyond 20,000 in one financial year then GIA can be an option. One person can hold as many ISA as he wants but can operate and invest through only one account in one financial year.

2)GIA

GIA stands for General Investment Account for shares and stocks. Account holder can invest without any limit in share market through this account. After using a limit levied by govt on ISA account GIA account is used for further investment. One can hold many accounts in this category and can operate though all. Income and profits generated through this account are subject to both Income Tax and Capital Tax. There is no restriction on selling and buying linked with this account. But Patience is considered as the main tool to grow and succeed in share market.

3)PPA

PPA stands for Private Pension Account. This account ties govt to pay 25% of your investment into the account. Money invested through this account is locked till you are 55. Any income and profits gained through this account do not account for any taxes. But pension received after you are 55 will be taxed as pension income.

Once you decide about the type of account you need to open. you will need to find a trusted broker to trade and invest.

After the Broker is shortlisted open trading account link it with a savings account and you are done. To start investing in life one needs keep positive

IMPORTANT NOTE: Please go through the Company Fundamentals before investing money in share market. And do remember investment in shares and stocks is subject to market risks.

2 thoughts on “Share market investment account – A beginner’s guide”