Recommendation of the Week

Name- Airtel Africa PLC

Airtel Africa plc, known as Airtel, is an international multinational company that provides mobile services including mobile money. It is also listed on the London Stock Exchange. Interestingly, it is serving in 14 countries in Africa mainly in West, East and also central Africa. It is a company majority owned by an Indian company serving in telecommunications sector, Bharti Airtel. Airtel Africa offers all the mobile services including voice and data as well as mobile money services both nationally and internationally.

Its another unit Airtel Nigeria, is one of the cheapest data service provider of Nigeria hence making it the most profitable unit for Airtel Africa. By the end of March 2019, Airtel had over 99 million subscribers in the continent.

Actual Business of Airtel Africa

It is a group engaged in the provision of mobile services in the continent. That includes voice services and data services. Airtel Money is its biggest service through which company gets access to available surplus in customers accounts. Voice services and data services are irreplaceable in the near future as people are more dependent on their mobiles for even day to day chores. This brings a safety in the minds of investors as we all know the actual backbone of investing in any company is its working. Their is rather a likelihood that the company will further invest in other companies as a takeover.

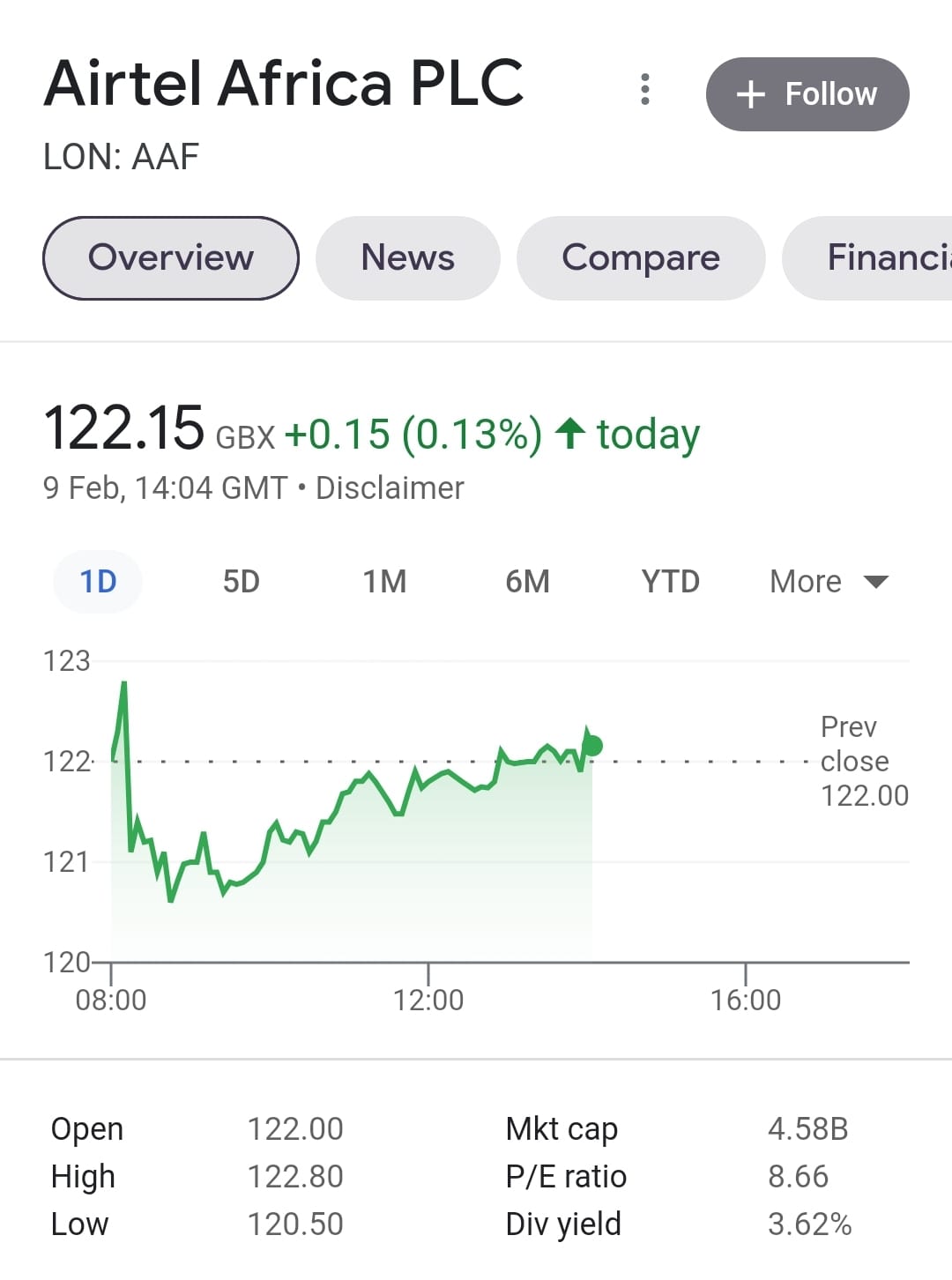

Market value of Airtel Africa

Key Financials of Airtel Africa reveals us that

-Cash Available with the company is almost £182,000,000.

-Net worth of the company is £690,000,000.

-Total Current Assets of the company are £1,000,000,000.

-Total current Liabilities of the company are £301,000,000.

Liabilities are not very high and company is active and growing in its main stream business.

Graph View of Airtel Africa

Trends in the share price of Airtel Africa Plc

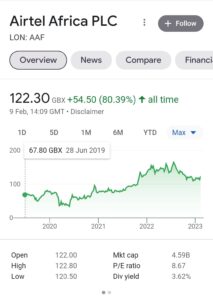

Airtel Africa Share was introduced on 28 June 2019 at 67.80 GBX. By the end of the year it reached 78 GBX. On 29 June 2022 it touched almost 159 GBX which was almost 225% in just 2 years time span. On average it is still up by 54.50 GBX almost 80.38%. 80% growth of investment in 3 to 4 years makes it a share worth investment. If we use compounding technique and keep investing in strong shares at dip Better returns and long term profits are obvious.

Profit declaration within last 4 months of launch

Airtel Africa launched its share in 2019 and it just declared its profit within 3 to 4 months of its launch. It was a huge profit of $ 228 million.

In the past year, as United Kingdom struggled and went through disturbed inflation and increase in interest rates disbalanced mortgage system bringing nation somehow to enter the zone of recession. Since 29 July 2022 Share price witnessed a fall of $45.4 from 158.80 bringing it to 113.40. Moreover, Recession or its news always brings share market rates to bottom. Additionally shares do face ups and downs as per major buying or selling. Over a longer period of time shares with strong backbone gives better returns and their share prices grow on average.

Airtel Africa, A Strong Share

In the end, Airtel Africa Plc is a share with a strong backup system serving 14 countries in Africa and a share introduced in London Stock Exchange. Moreover it is also a listed share in FTSE100. Furthermore its main stream is mobile and data services which is a sector always in demand and nothing seems to overtake or replace it. Additionally Airtel money services brings surplus in hand for the company to act more freely taking business and investment decisions. Hence, it is a company with lots of strengths and surplus to grab opportunities of future.

No doubt, It is a new share should give good returns in the long run but the major investors of the share are Bharti Airtel, a strong company from India. Bharti Airtel was itself introduced in 2008 and served billions of customers worldwide. I would go optimistic here and consider it a one in a million chance to buy this shares with compounding. Compounding here simply refers to buying at a dip.

Last but not the least, I have always recommended my readers to buy small portions at dip and keep diversifying their investment portfolios to avoid any one company’s fate to affect them harshly. A share recommended today may not fit the portfolio in future. Hence it is the duty of the investor to keep a track on key financials of the companies they in your portfolios. I also recommend a beginner’s guide to share market. Do follow us on Facebook.

Disclaimer

Inspobird is creating articles without any intention to provide direct advice. It is purely an information website just to help readers understand company profiles with their key financials. When you go through our articles, it is equally important to go through actual company profile. We also try and collect company information from same sources.

It is very important to consult a financial advisor before making any serious financial investments. Share market investments are subject to market risks. Hence, InspoBird do not take any obligation made by readers. Again, Please choose and invest wisely.