Recommendation of the Week

Name- National Express Group PLC

National Express Group public transport based company from Britain with headquarters in Birmingham. Basically, it is a multinational public transport service provider and operates not just only bus service but also coach, train and tram services in the United Kingdom, Ireland, United States, Canada, Spain, Portugal, Malta, Germany, Bahrain, and Morocco. Moreover they are the long-distance coach service providers across Europe.

Actual Business

It is a group engaged in the provision of services in the transport industry at mass level not just in UK only but overseas as well. Maybe, ff you have ever visited UK you must have travelled and enjoyed the services provided by the company locally. Else in many countries from Europe are as well using them as service providers for travel and transport.

Market value of National Express

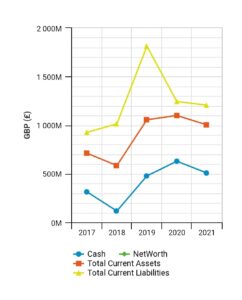

Cash Available with the company is almost £508,400,000.

Net worth of the company is -£371,400,000.

Total Current Assets of the company are £1,003,900,000.

Total current Liabilities are £1,206,500,000.

Graph View

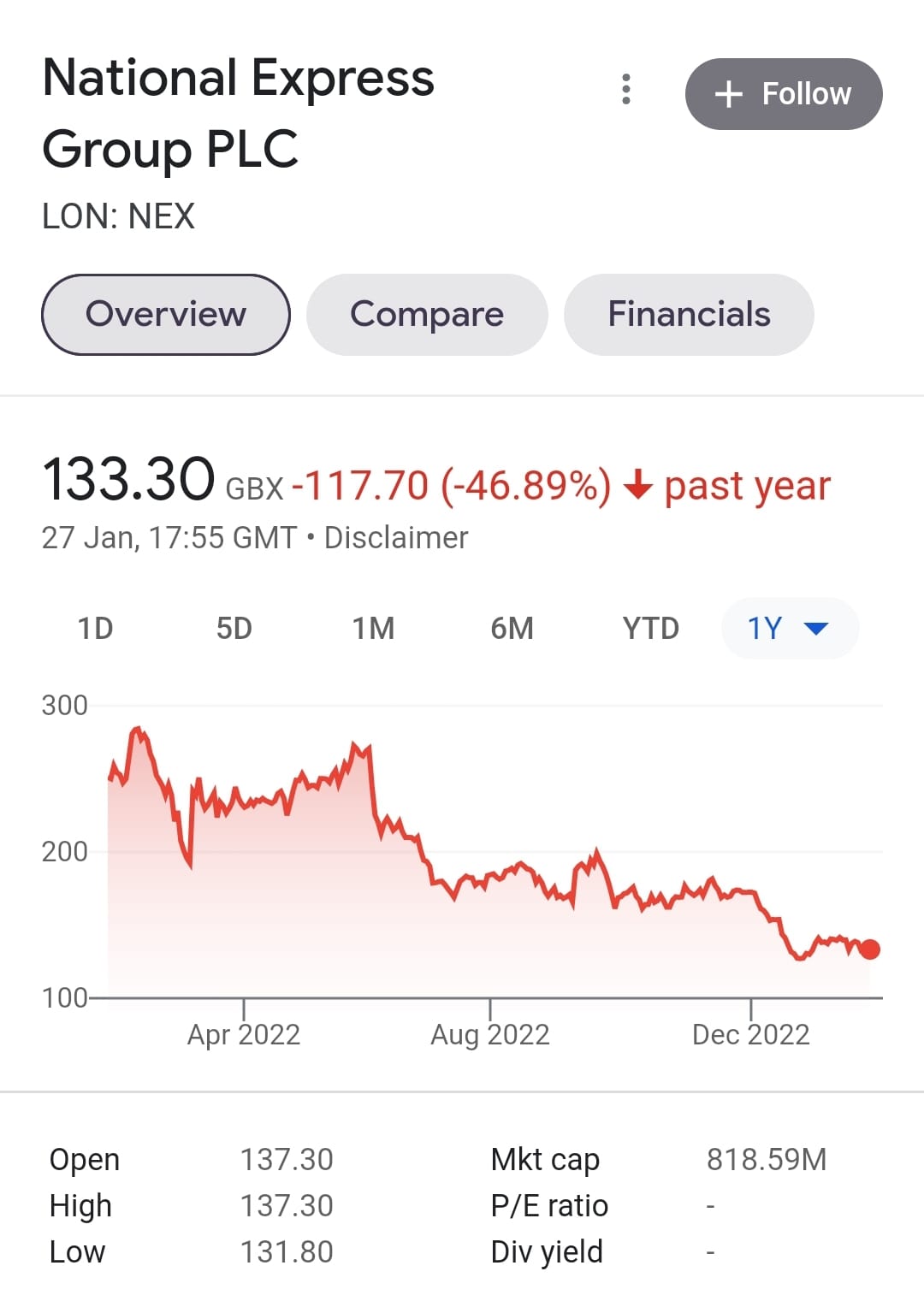

Trends in the share price of National Express

National Express Share was introduced on 26 March 1993 at 99.74 GBX. By June 1999 within 6 years its price hit 587 GBX which was almost 600% up and in sept 2007 and it reached 635 the highest of its time. On average it is still up by 32.02 GBX almost 32%.

Last 5 years of National Express

In the last 5 years share price witnessed a 63% fall and the major hit was none other than covid19. Worldwide lockdowns bought the world to a complete standstill and majority of service based industries got smashed struggling to keep up with their regular expenses. Same happened with National Express as services were not used and then started considering social distancing. Many jobs shifting to hybrid as well distressed its recovery.

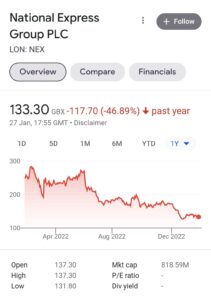

Past year’s performance

In the past year, UK struggled to go through inflation and increase in interest rates disbalanced mortgage system bringing nation somehow to enter the zone of recession. Moreover, regular strikes by national express employees demanding an incremental on wages hit the share price badly. Last financial year witnessed almost 47% fall in the share price.

In the end, National Express is a share with a strong backup system serving England and Europe with Bus, Train and Tram services. Also, Failure of such a company can leave their system in a mess and govt will have to overinvest to immediately replace its services or support the company to avoid all of it. Hence, if we look at the price today it is almost the same as of year 2009. I would go optimistic here and consider it a one in a million chance to buy this shares with compounding. Compounding here simply refers to buying at a dip.

Last but not the least, I have always recommended my buyers to buy small portions and spread their investments to avoid any one company’s fate to affect them harshly. I also recommend a beginner’s guide to share market. Follow us on Facebook.

One thought on “A must have share in the beginners portfolio in uk”